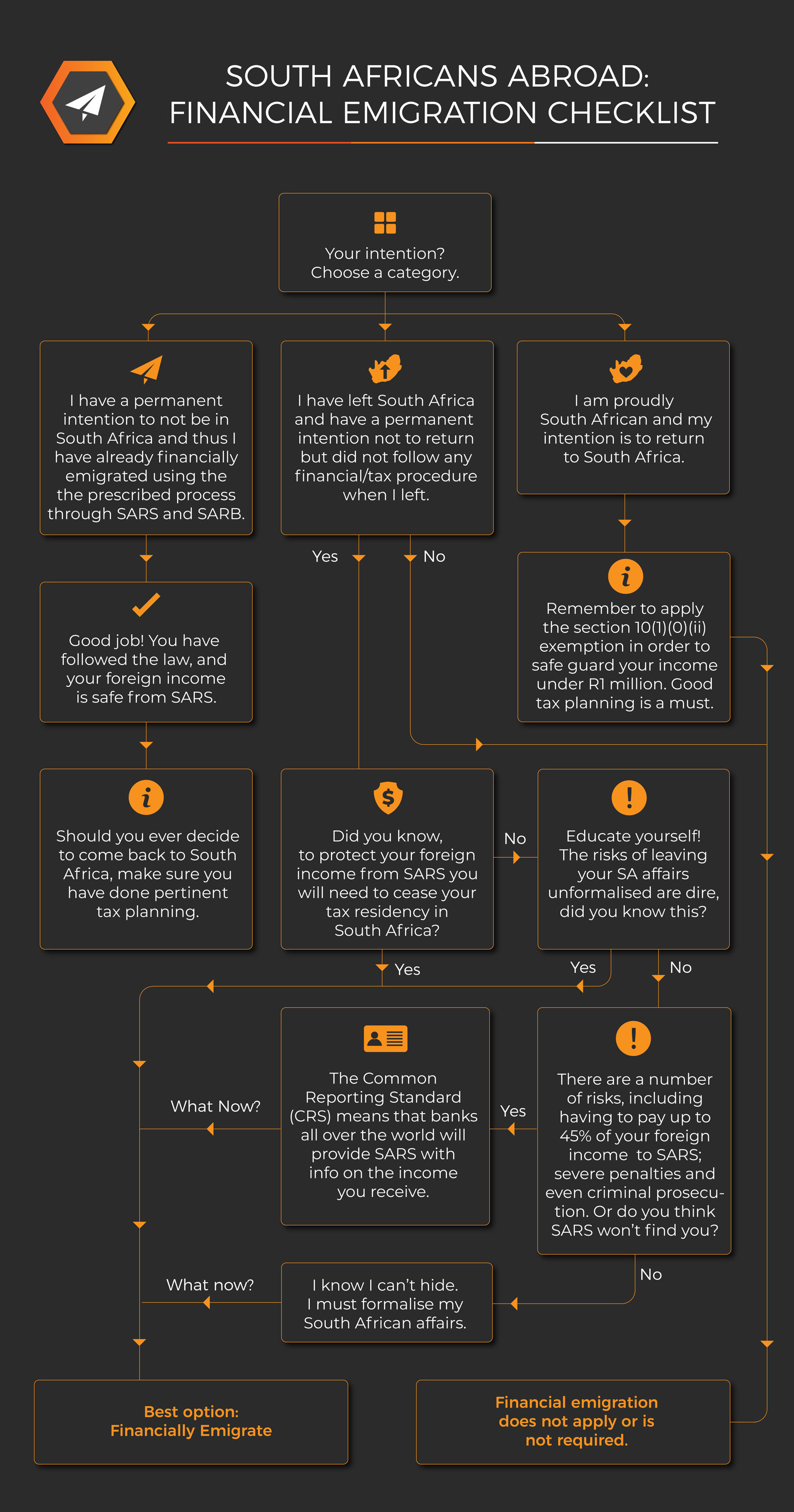

The new expatriate tax law comes into effect 1 March 2020. However, many South Africans abroad believe that the law has not been legally amended and will thus not affect them. This belief is unfortunately incorrect, as the law change has been fully enacted. We have provided a concise breakdown of the tax law above to help you better understand the requirements thereof, and whether or not it is prudent to formalise one’s emigration through SARS and the South African Reserve Bank to protect foreign income earned from South African tax.

Find Us

Johannesburg

17 Eaton Avenue

Bryanston

Gauteng, 2191

South Africa

George

55 York Street

Dormehls Drift

George, 6529

South Africa

Contact Details

Telephone:

South Africa: 011 467 0810

International: +27 11 782 5289

Email:

contact@financialemigration.co.za

In the News

Important Tax Directive Updates from SARS will impact expats’ withdrawal of retirement interests12/04/2025 - 06:39

Important Tax Directive Updates from SARS will impact expats’ withdrawal of retirement interests12/04/2025 - 06:39 Don’t be misled: No waiting period for SA expats who want to cease tax residency25/03/2025 - 19:07

Don’t be misled: No waiting period for SA expats who want to cease tax residency25/03/2025 - 19:07 Understanding South Africa’s Exit Tax and the Proposed Tax on Retirement Interests25/03/2025 - 09:10

Understanding South Africa’s Exit Tax and the Proposed Tax on Retirement Interests25/03/2025 - 09:10 Talk of a Wealth Tax in South Africa is just not going away05/03/2025 - 10:42

Talk of a Wealth Tax in South Africa is just not going away05/03/2025 - 10:42 South Africa’s Financial Future in Limbo – Should You Exit Now?01/03/2025 - 08:11

South Africa’s Financial Future in Limbo – Should You Exit Now?01/03/2025 - 08:11