Aggressive enforcement

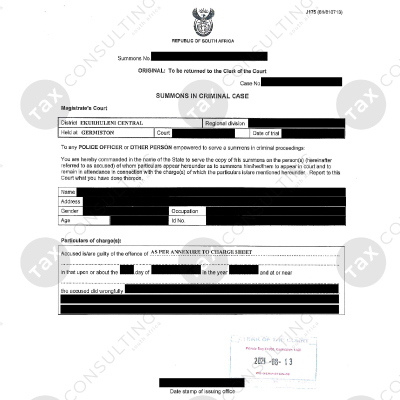

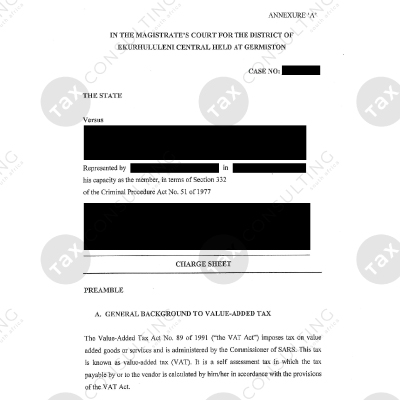

From the summonses we have seen, it is evident that SARS and the NPA treat this form of delinquency very seriously. The charge sheets are prepared carefully and every instance of non-compliance, for every tax type, counts towards a separate charge. This means that some taxpayers face up to 30 counts of contravening the Tax Administration Act. The gravity is underscored by the fact that it appears that the Hawks have been involved to investigate some of these cases, who serve these summonses on the taxpayer personally.

What if I live abroad?

There is a sentiment among South Africans who have left our shores that their South African tax obligations are in the rear-view mirror. Perhaps this because they believe that SARS cannot be bothered to enforce against taxpayers who no longer reside in South Africa. It is important to understand that the failure to file returns constitutes a criminal offence under South African law and nothing precludes the NPA to summon a taxpayer to face criminal charges in South Africa long after they left the country. Criminal proceedings may still be instituted up to 20 years after the offence was committed.

Enforcement by example

SARS has undertaken to make it costly for taxpayers who flout their tax obligations. A key part of this initiative is to make an example of delinquent taxpayers. For South African abroad, SARS and National Treasury are on record that they are aware of the pervasive non-compliance among expatriates, which was one of the main drivers for the enactment of the “expat tax”. Moreover, SARS has made it clear that this is a key area of enforcement for the institution, and it will only be foolish to assume that you are beyond the NPA’s reach.

If you are unsure of your obligations, it will be prudent to do a diagnostic of your tax affairs. If you are found to be non-compliant, it will be wise to rectify your position before you receive an invitation from the NPA to return to South Africa.