When it comes to ceasing tax residency, one cannot simply tick the box. Despite misleading views peddled by “experts” on social media that the process of proving one’s residency status is exaggerated, SARS has now proven that this is not the case. Expatriates must ensure that they are able to support the contention that they are non-resident for tax purposes.

Declaration of non-residency to SARS

SARS recently confirmed the legal routes through which expatriates can cease tax residency which we covered here. In summary, there are three bases for proving that you are no longer tax resident. These are; (1) demonstrating that you are not ordinarily resident; and (2) proving that you do not meet the requirements of the physical presence test; or (3) declaring non-residency through a Double Tax Agreement (DTA). In each case, expats must be aware that the onus lies on you as a taxpayer to properly support your position.

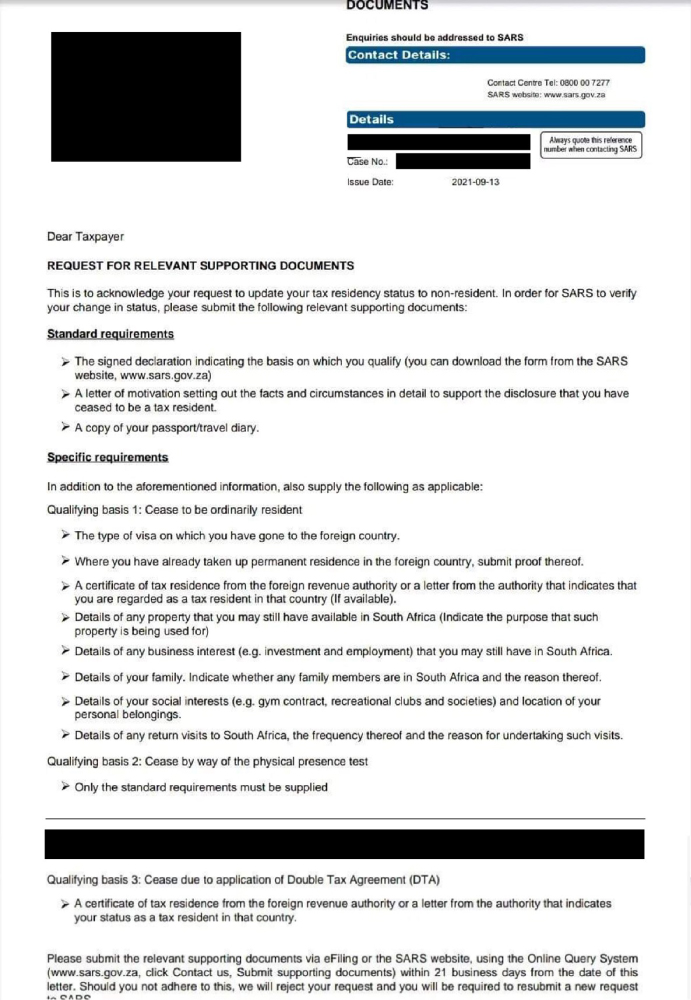

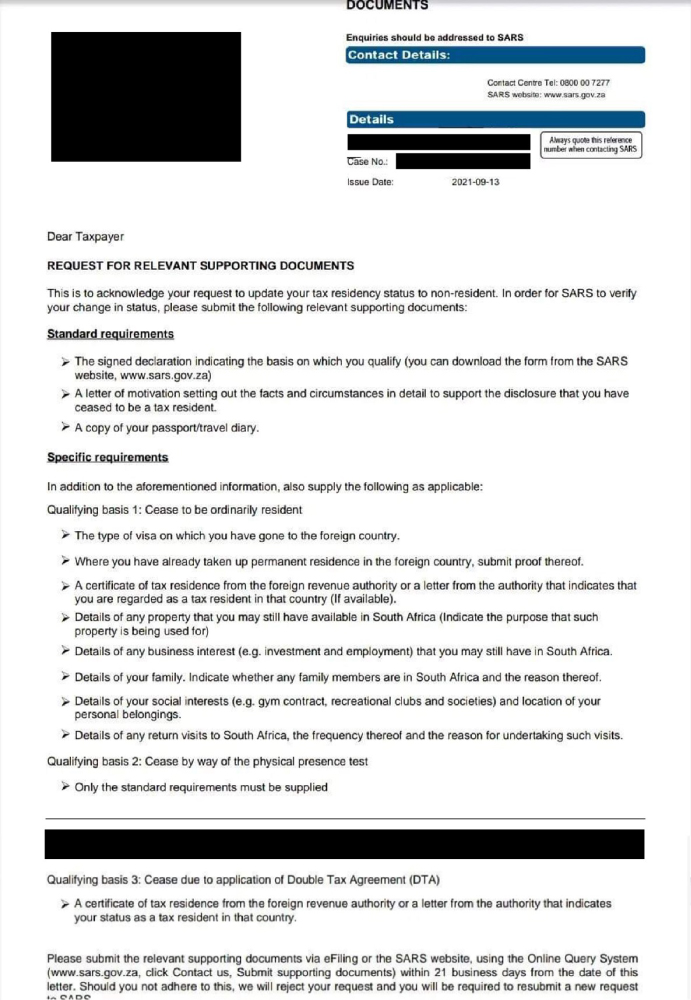

Audit Requests

To make good on its promises, SARS is now sending out audit letters requesting substantiating documents / information to those alleging that they have ceased tax residency through the tick-box approach. These audit requests show that it is not a simple process, but an exhaustive factual enquiry. Any expat that is not able to prove the basis upon which they have ceased tax residency will have their non-residency declaration rejected by SARS. Excerpts of the audit letters from SARS are shared below for reference:

Be Wary of Misleading Advice

Expats need to be made aware off the dodgy approaches offered to ceasing tax residency, with the tick-box approach being one of them. Another example is where the taxpayer is erroneously advised to declare non-residency under the DTA, without requesting a tax residency certificate from the foreign tax authority. It must be stressed that this is an absolute requirement from SARS.

Relying on these illegal approaches will lead to the imposition of penalties by SARS or criminal prosecution. Some remarks that should indicate that you are being misled include:

- Ticking the non-resident box in your returns is proof that you have ceased your tax residency

- You are considered a non-resident if you have been outside of SA long enough

- If you work abroad and pay foreign taxes, you do not need to submit returns in SA or declare anything to SARS

- You are automatically exempt from tax in RSA because of a DTA

- SARS does not have access to information on your foreign earnings or assets

- There is no need to obtain a tax residency certificate from foreign tax authorities

- You must liquidate all your assets to cease South African tax residency

Know your SA tax residency status

If you have already ceased your tax residency and are not sure whether this was done on the correct basis, it is not too late. You can engage SARS directly by sending a letter for clarification or approach a competent tax firm with a strong legal component for a second opinion. The alternative should ideally occur before SARS audits your tax profile.