Steps to Obtaining Financial Emigration

There are many reasons why South African tax and exchange control residents undertake the financial emigration process. The main reason is this being a legal requirement and part of the “formalities” which a South African must undertake when permanently moving abroad. There has historically been many South Africans who moved permanently abroad and that have not undertaken the correct tax and exchange control formalities and this is one of the focus areas mentioned on 19 August 2017 in Parliament’s Standing Committee of Finance on which audits will be done and compliance enforced.

The process effectively includes three steps:

(a) your bank must execute form MP366, then

(b) SARS must issue a IT21(a) Tax Clearance,

(c) finally the Reserve Bank must approve the submission.

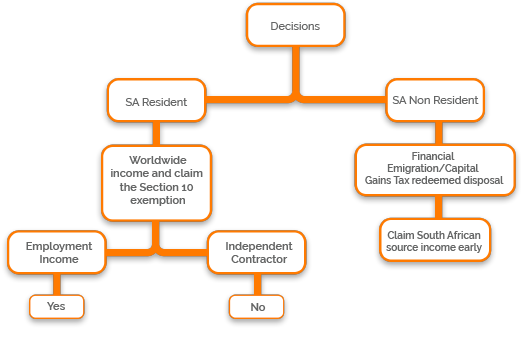

There are complexities to the SARS process as the emigration date is also a deemed tax disposal date for world-wide assets (see below) and there are certain instances where a Tax Clearance certificate is not required.

The other reasons why South African emigrants have also done financial emigration are:

(i) the taxing out of foreign allowances, so typically for someone who needs to move South African money abroad,

(ii) a formal requirement to access your retirement annuities, as the Income Tax Act requires financial emigration to undertake lump sum withdrawal, as well as

(iii) in certain countries to evidence that you have left South Africa permanently and may assume tax residency and domicile there.