Word of these training sessions, spread beyond the borders of Southern Africa, much like the business impact of the AIT process. This resulted in the South African Chamber of Commerce, based in the UK, requesting a private session for their members.

In attendance were a number of wealth managers and C-Suite Execs, from all over the world, including the UK, Switzerland, Guernsey, and Croatia.

Alignment on the AIT

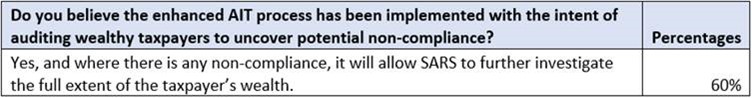

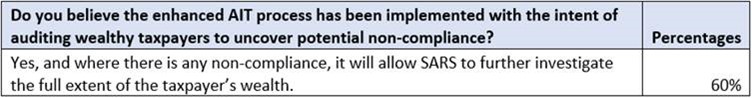

When census was taken of only South African based advisors and practitioners, it was quite clear that the vast majority, aligned with the AIT process potentially opening a window for SARS to further investigate the full extent of taxpayers’ wealth.

With this borne in mind, it came as no surprise when the consensus from the Chamber of Commerce was aligned with this precisely.

Poll Results from Tax Consulting South Africa Training webinar with the South African Chamber of Commerce, based in the UK, on the new AIT Process.

Following the Money, Offshore?

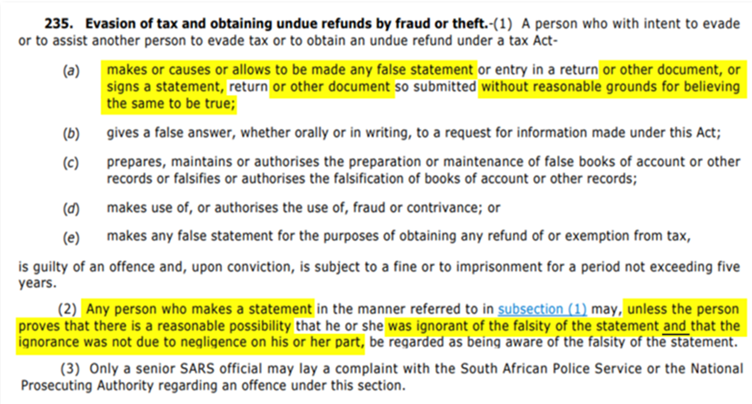

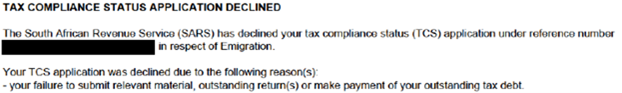

With SARS in essence “following the money”, there are no bounds on the revenue authority’s investigative and audit powers. This is made evident when a high-level overview of the rationale for AIT, as well as potential sanctions for non-compliance, are considered:

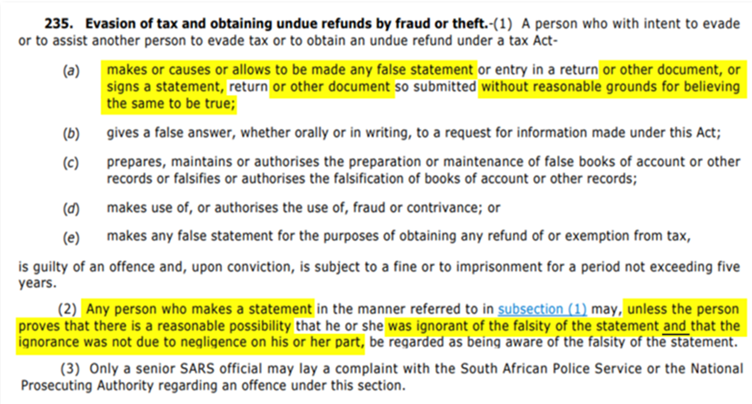

Screenshot of Section 235 of the Tax Administration Act.

With the increased risk of criminal sanctions under section 235 of the Tax Administration Act, understanding the 3 pillars upon which the AIT process is built, is essential, namely:

- Source of Funds to be Transferred;

- Detailed Statement of both Local and Foreign Assets and Liabilities (At Cost AND Market Value); and

- Destination of the Funds – not just the jurisdiction, but also the type of venture / investment.

Criminal sanction can become the reality for many in an instant when any false statement, intentionally, or inadvertently, is submitted to SARS, accompanying an AIT request. However, where the correct financial due diligence, in the form of a Reasonability Test, is conducted, this can be easily mitigated.

Risk and Reasonability

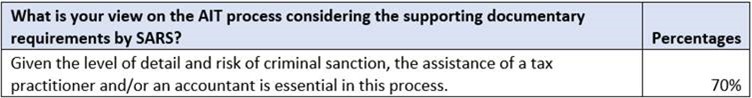

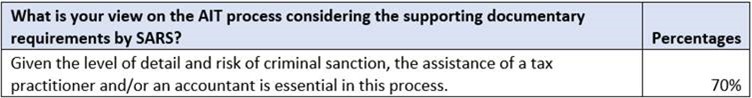

Navigating the international movement of large sums of money, and high-value assets has historically been tricky tax terrain. In light of the extensive declarations required under the enhanced AIT process, even foreign wealth advisors and Execs have agreed:

Poll Results from Tax Consulting South Africa Training webinar with the South African Chamber of Commerce, based in the UK, on the new AIT Process.

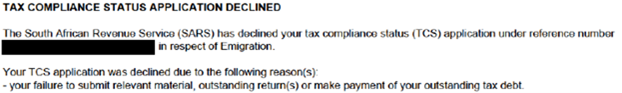

With SARS, and other revenue authorities, strengthening their tax treatment, ensuring the prudent approach is followed, is essential. From a practical standpoint, this must commence with a tax diagnostic being concluded; this compliance check, including CIPC and other financial interests, will educate the best practice to be followed – better diligent than declined for non-compliance:

Once concluded, and in-line with SARS’ schedule of required disclosures, conducting a Reasonability Test may be the key difference between a justifiable AIT request, and being short-changed, for being short of funds:

Statistically speaking, given the in-depth documentary requirements and risk analysis, professional assistance is essential; and where the correct strategic roadmap is followed, AIT Approval is a Reasonability Analysis away.

Prior Due Diligence Most Prudent

As a rule of thumb, all disclosures required by SARS should primarily be vetted by a qualified tax specialist or tax attorney. As specialists in their own right, this ensures accuracy and full transparency when dealing with the revenue authority. Further to this, ensuring sufficient transferable / liquid funds are available, is essential; a Reasonability Analysis serves to confirm just this, with the finding being on what justifiable amount, the taxpayer qualifies to transfer.

By automatic operation of a pragmatic, yet prudent risk-averse approach, the chances of SARS rejecting an AIT application are significantly reduced.

However, where a taxpayer has already undertaken the disclosure themselves, and a subsequent audit ensues, asset protection is needed. Enlisting seasoned tax attorneys will serve to do just that, whilst also preventing potential prosecution, and ensuring fulfilment of all documentary requirements.